General Use

This document is for general use. Modification of content is prohibited unless you have Netwealth’s express prior written consent.

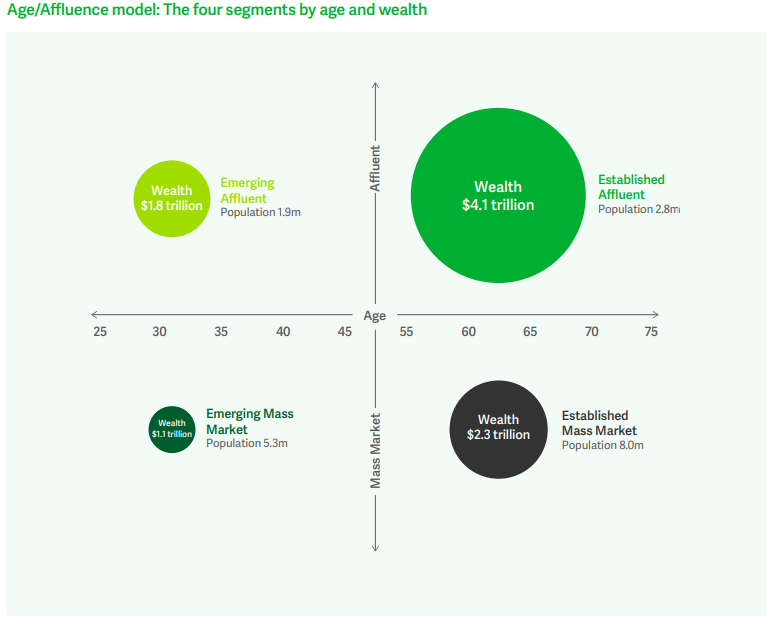

The Established Affluent are one of the four main segments of “Advisable Australians”, based on Netwealth’s annual research into Australian investors 18+.

They represent only 16% of the Advisable Australian population 18+, yet hold approximately 44% of the wealth, with a total household wealth of approximately $4.1 trillion. This represents a huge opportunity for financial advisers currently, or interested in, servicing the High-Net-Worth market.

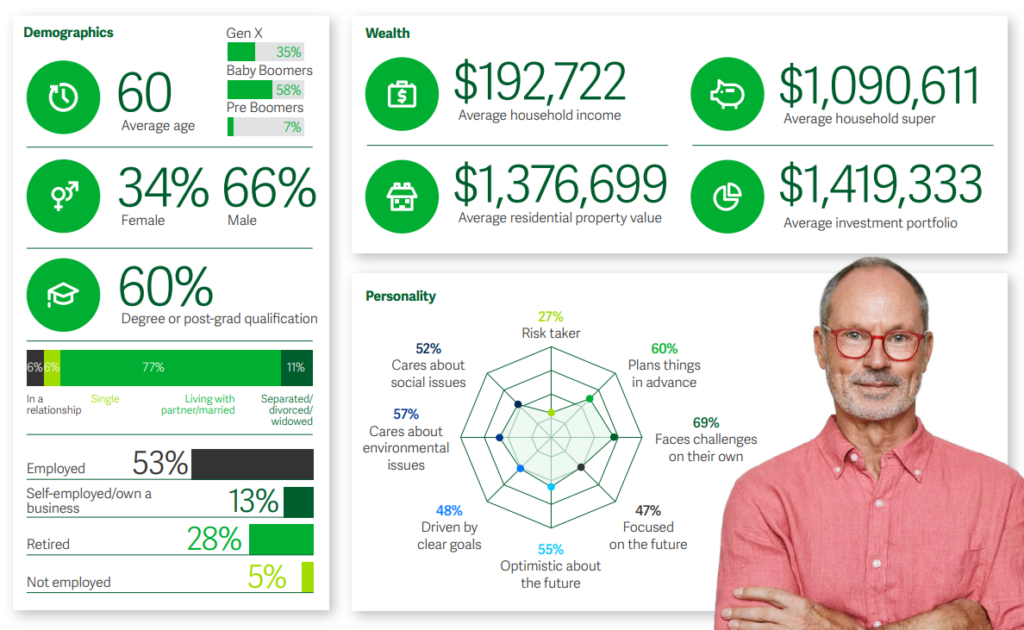

A closer look at what defines this demographic:

The Advisable Australian Report – Demographic and personality profile of the Established Affluent (Page 8).

Age – They are aged 45+, with an average age of 60 years.

Sex – They have the highest proportion of males of all segments, at 66%

Education – They are highly educated, with 60% holding either a degree or post-graduate qualification.

Employment – They are high income earners, with an average household income of approximately $192,000. Also important to note – only 28% are retired.

Wealth – They have an average household wealth of approximately $3.1 Million.

This demographic is well-established with significant resources and are seeking advice, with three in five (61%) of the Established Affluent either currently using, or considering engaging with, a Financial Adviser.

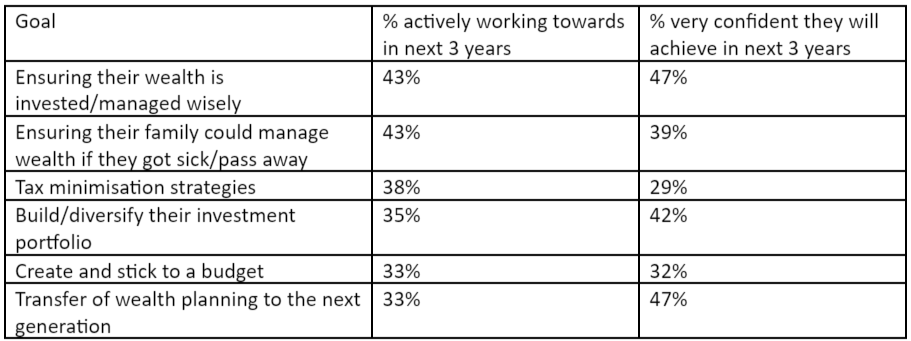

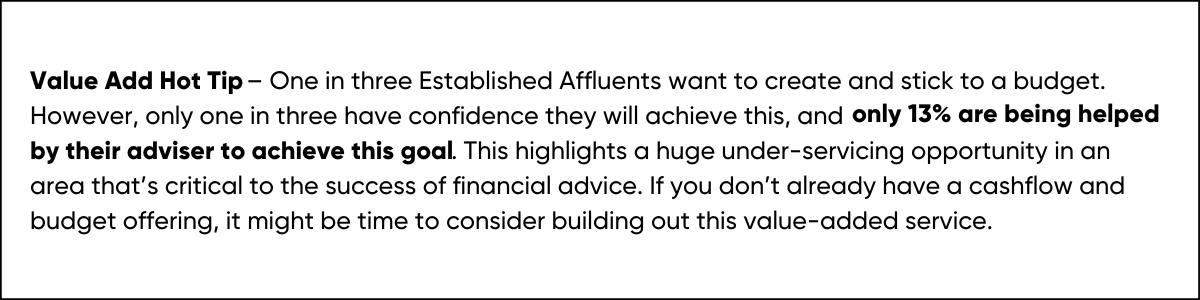

Whilst this is in part due to their healthy asset base, they also have some significant goals that they are working towards but aren’t confident in achieving, which represents an advice opportunity that advisers could consider expanding into.

Unsurprisingly, the most common goal within this demographic is ensuring there is enough money for retirement, with 62% actively working towards this in the next 3 years.

However, only one in three (35%) are very confident they will achieve this in the next three years, despite two in three (64%) being helped by their Adviser to achieve this goal.

Other common goals amongst the Established Affluent are:

The Advisable Australian Report – Profiling the Established Affluent (page 13)

It’s no surprise then that this demographic wants and needs high-quality, comprehensive advice and services from their financial adviser.

How do you tailor an advice service offering to this demographic?

Risk Tolerance & Diversification

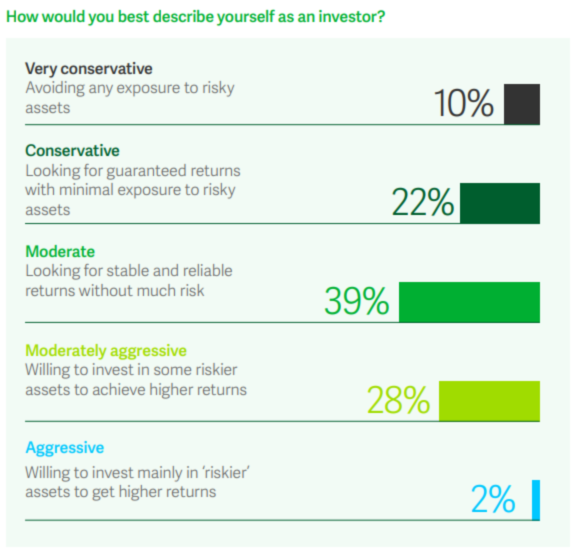

The Established Affluent typically identify themselves as risk averse, with 71% considering themselves to be either very conservative, conservative or moderate investors with a preference towards capital preservation within their portfolios.

The Advisable Australian Report – Tailoring your advice offer for Established Affluents (page 14)

Interestingly, this translates to investment and superannuation portfolios that are primarily made up of the major asset classes, with over 50% allocated to residential property and Australian equities. However, they have largely expressed an interest in further diversifying their portfolios, with over half saying that they would consider investing in Bonds, Gold, Infrastructure, Managed Accounts, Commercial Property and ETFs.

This highlights opportunities for Advisers to expand investment portfolio offerings and further diversify their clients’ portfolios in line with their investment preferences.

A great way to support the Established Affluent on their investment journey is through investment education. It’s recommended that advisers servicing this demographic incorporate an educational element into advice offerings. Informative content such as articles, newsletters, podcasts and/or short form video content are all great ways to educate clients about investing, diversification, asset classes, investment types, risk and return etc.

Responsible Investing

It’s a common belief that social and environmental issues are a concern only held by the younger generations, and this proves false when it comes to the Established Affluent’s desire to invest responsibly.

With 1 in 3 currently invested in responsible options and a further 45% considering them, Advisers need to ensure they have portfolio solutions and investment offerings to match these needs and preferences when servicing this demographic.

It’s also important to understand the various types of socially responsible options – from ESG & Negative Screening to Sustainable Positive Screening to Impact and Concessional Return Investing and more. The responsible investment market has evolved significantly over recent years, providing the opportunity for bespoke and intricate portfolio tailoring, based on individual needs.

Investment Structure

Lastly, it’s not uncommon for an Established Affluent to utilise various entities and ownership structures, including partnerships (3%), trusts (11%), corporate structures (9%) and SMSF’s (19%), when managing their business and financial affairs.

These structures play a critical role in strategies relating to tax minimisation, succession planning and intergenerational wealth transfer, so Advisers should have a comprehensive understanding of these to best service this demographic.

Building value-added services beyond wealth

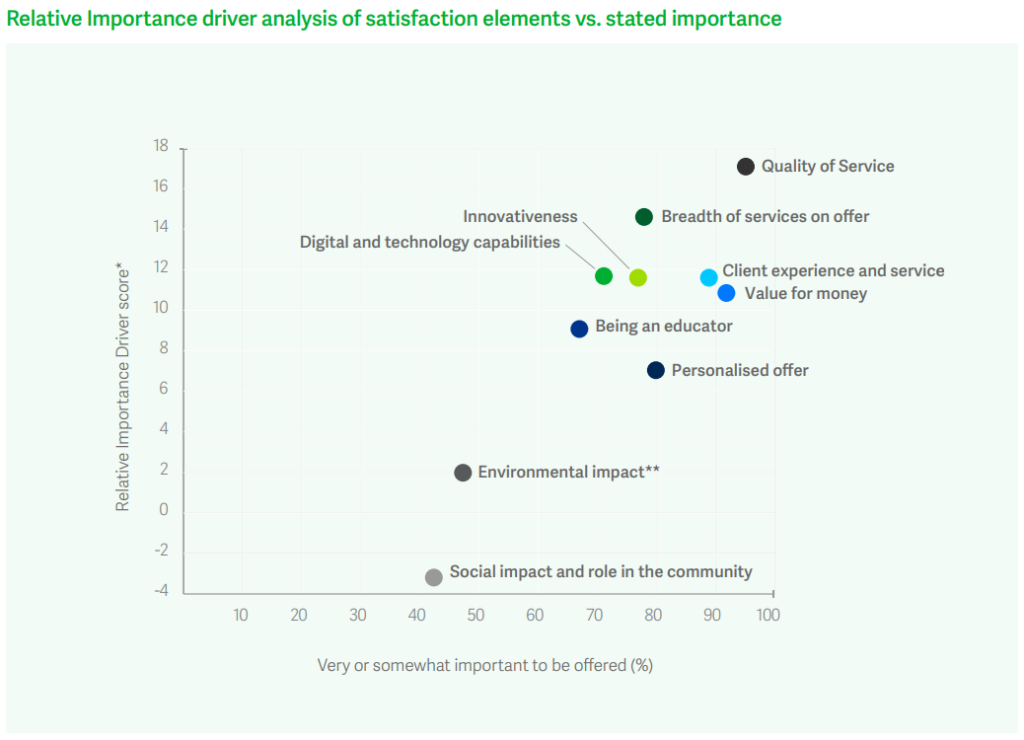

The Advisable Australian Report – Profiling the Established Affluent (page 14)

The Establish Affluent value breadth of services – it is the 2nd most important driver of satisfaction behind quality of service. Again, this is likely due to the complexity of their situation with many needing accounting and tax advice, estate planning, business structuring advice, business planning services, lending advice, stockbroking advice, private banking and aged care planning.

While there are a number of ways to build out your offering of value-add services, the most accessible path for Advisers is to establish a network of trusted and reputable service providers to partner with, where they become the concierge or access point to an expert team of professionals working together to manage their wealth affairs.

Intergenerational Wealth

The Established Affluent are particularly concerned with the future of their wealth, with many having goals around estate planning and ensuring their family could manage their wealth, in the event they are sick or pass away.

This highlights an opportunity for Advisers to build out their service with a framework that supports the transfer of wealth between generations. This might include creating a service offering tailored to the needs of the next generation. It will be important for Advisers to create a relationship and engage with the next generation prior to a wealth transfer event actually taking place.

It’s clear that the Established Affluent are not your average investor as they have big goals and complex needs. However, they also have the resources and drive to achieve them when backed by a Financial Adviser that’s equipped to provide a comprehensive and quality advice service.

With this in mind, how might you expand your service offering to better meet the needs of the Established Affluent?

_ _

This article was written based on Netwealth’s 2022 Advisable Australian Report along with their video overview, which is a playbook for financial advisers on how to attract, advise and service the Established Affluent.

You can access Netwealth’s range of ‘The Advisable Australian’ resources here, including:

- 2022 Advisable Australian Report & Video Overview

- A roundtable discussion with advisers servicing this client base

- Three masterclass presentations exploring different aspects on how to acquire and service the Established Affluent

- And much more…

This article has been prepared and issued by Netwealth Investments Limited (Netwealth), ABN 85 090 569 109, AFSL 230975. It contains factual information and general financial product advice only. While all care has been taken in the preparation of this information (using sources believed to be reliable and accurate), no person, including Netwealth, or any other member of the Netwealth group of companies, accepts responsibility for any loss suffered by any person arising from reliance on this information. Any person considering a financial product from Netwealth should obtain the relevant disclosure document at www.netwealth.com.au.

¹ Netwealth’s Advisable Australian report examines the financial attributes and preferences of Australians based on a survey of more than 1,500 people aged 18+.