The passive versus active fund management debate has raged on for quite some time and although opinions may still vary, there is one area of the market which stands out in favour of passive management – thematic investing.

As ETFs have become more sophisticated and understood by advisers and clients alike, numerous products have come to market to fill ever-increasing demand. Thematic ETFs covering a wide range of investment opportunities can be a cost-effective, diversified and transparent way to get your clients access to specific areas of the market. But why is that?

Bullseye: Pros of Targeted Exposure

As investors become more educated – largely thanks to financial advice – they often seek more tailored solutions to address their investment needs. This can mean utilising alternatives in a portfolio to stem correlation issues, thinking about investments with an ESG lens or moving to a core-satellite approach to seek alpha on top of low-cost core exposures. Regarding the latter, Global X has seen a strong use case for thematics as they provide very targeted and specific investments over broader active funds when seeking alpha.

Understand and Meet Client Expectations

As well as wanting more targeted exposure, many clients’ expectations around portfolio construction and performance are becoming more specific. These expectations, compounded by recent years of volatility, means advisers need to have more diverse products and solutions on hand. Similarly, if there are pockets of the market or a particular asset class which is outperforming, your clients are likely to expect you to be aware of ways to capture this trend – particularly for themes with structural tailwinds and growth potential.

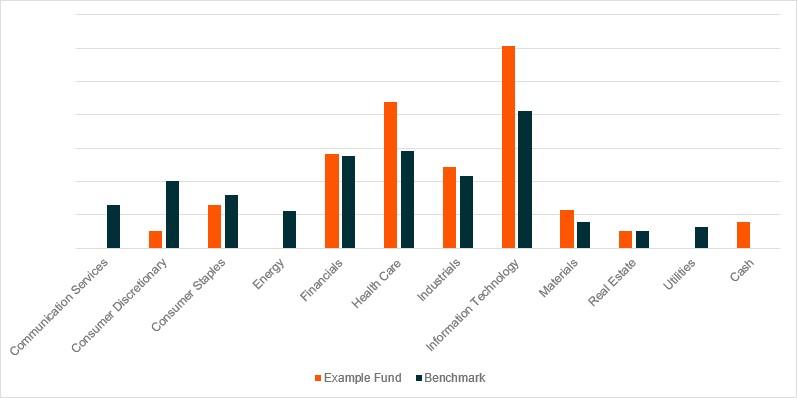

Taking a very simple example as shown in the chart below, an adviser may fail to meet client expectations if they have the client invested in what they believe to be an actively managed diversified global equities fund, but in reality, the fund has a strong skew towards high growth stocks such as tech because of the more selective, subjective nature of active management. This mismatch of expectations can also be exacerbated due to the level of secrecy or delay active funds may have in reporting their holdings.

Meanwhile, thematic ETFs are typically designed to target a niche area of a specific market which means the outcome of an investment in these funds is more likely to align with client expectations. Meeting expectations does not mean an ETF will not go down, nor can ETFs prevent clients from losing money – rather, it means a client can have a firm understanding of what they are investing in and an adviser can manage expectations accordingly. For instance, a client invested in a FAANG ETF knows the exact stocks they hold, the weightings and can get an indication, by the price action of these individual stocks, how the ETF should be performing at any given time.

Lower turnover (and associated costs of trading) of ETFs is usually beneficial, in comparison to higher turnover active funds, with any changes on the back of a semi-annual or quarterly rebalance reflected accordingly.

What Makes for Quality Criteria

Gaining targeted exposure and meeting client expectations ultimately boils down to a funds’ construction. Active funds tend to have a broader focus area (think global or Australian equities, or investment grade bonds) and a rigorous investment process with either a combination of quantitative analysis and/or direct securities picking. Due to human nature, there is an inherent personal bias built into active funds (which can also be a good thing) influencing the investment thesis or allocation. As a result, using active funds for more specific thematic investing may lead to sector skewing away from what’s intended and, again, possibly leading to a mismatch of client expectations.

Meanwhile, passive funds implement predetermined, rules-based criteria to identify stocks for each thematic ETF. These rules can be very specific to hone in on a number of important factors such as market capitalisation, liquidity, revenue requirements or geographies (to name a few).

ETF Efficiencies to Keep in Mind at all Times

Finally, it is worth reiterating the general efficiencies of using ETFs. As always, it is vital to consider an individuals’ financial position and risk appetite before making any investments.

- Cost-efficiency – Avoid sacrificing your client’s potential returns on high management fees and possible performance fees which are often associated with actively managed funds. By using indexes, passive funds are able to provide scalable access, generally at lower MERs.

- Lower turnover – Due to the less frequent nature of index rebalances, ETFs generally have lower turnover than active funds and hence keep other costs, like trading, lower.

- Transparency – ETF providers are required to list out the holdings and weight of each passive fund. This ensures you and your client always know what is being held in a portfolio. However, in active funds there can be up to a three-month lag in fund update information being available to the market.

Passive investing through ETFs is an effective and efficient way to leverage a broad selection of future-focused opportunities in clients’ portfolios. That is not to say active management does not have a place in a portfolio, but as an adviser looking for a transparent, cost-effective vehicle to capture structural trends across numerous markets, it is difficult to go past thematic ETFs. Thematic ETFs, when used as a part of a well-diversified portfolio, have the power to provide customised solutions to meet individual client expectations from income and capital growth to decarbonisation.

Disclaimer

This document is issued by Global X Management (AUS) Limited (“Global X”) (Australian Financial Services Licence Number 466778, ACN 150 433 828) and Global X is soley responsible for its issue. This document may not be reproduced, distributed or published by any recipient for any purpose. Under no circumstances is this document to be used or considered as an offer to sell, or a solicitation of an offer to buy, any securities, investments or other financial instruments. Offers of interests in any retail product will only be made in, or accompanied by, a Product Disclosure Statement (PDS) which is available at www.globalxetfs.com.au. In respect of each retail product, Global X has prepared a target market determination (TMD) which describes the type of customers who the relevant retail product is likely to be appropriate for. The TMD also specifies distribution conditions and restrictions that will help ensure the relevant product is likely to reach customers in the target market. Each TMD is available at www.globalxetfs.com.au.

The information provided in this document is general in nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information in this document, you should consider the appropriateness of the information having regard to your objectives, financial situation or needs and consider seeking independent financial, legal, tax and other relevant advice having regard to your particular circumstances. Any investment decision should only be made after obtaining and considering the relevant PDS and TMD.

This document has been prepared by Global X from sources which Global X believes to be correct. However, none of Global X, the group of companies which Mirae Asset Global Investments Co., Ltd is the parent or their related entities, nor any of their respective directors, employees or agents make any representation or warranty as to, or assume any responsibility for the accuracy or completeness of, or any errors or omissions in, any information or statement of opinion contained in this document or in any accompanying, previous or subsequent material or presentation. To the maximum extent permitted by law, Global X and each of those persons disclaim all any responsibility or liability for any loss or damage which may be suffered by any person relying upon any information contained in, or any omissions from, this document.

Investments in any product issued by Global X are subject to investment risk, including possible delays in repayment and loss of income and principal invested. None of Global X, the group of companies of which Mirae Asset Global Investments Co., Ltd is the parent, or their related entities, nor any respective directors, employees or agents guarantees the performance of any products issued by Global X or the repayment of capital or any particular rate of return therefrom.

The value or return of an investment will fluctuate and an investor may lose some or all of their investment. Past performance is not a reliable indicator of future performance.